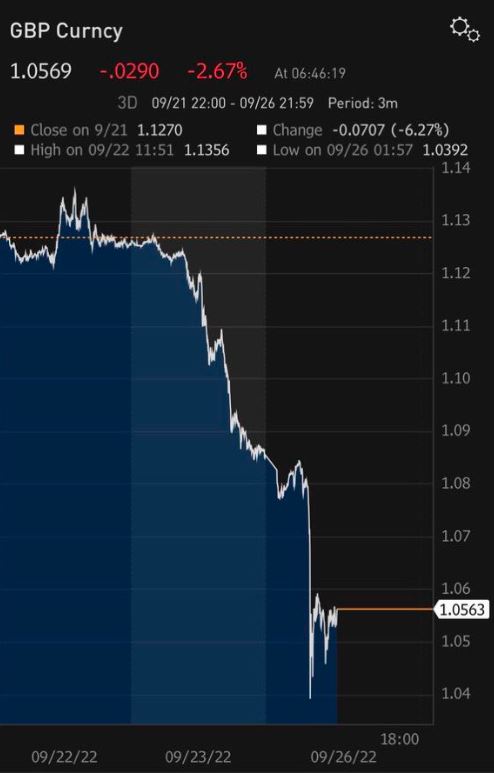

The pound has plummeted to its lowest ever level against the US dollar after the new Conservative government’s mini-budget collapsed confidence in the UK’s economic management.

Early trading on Monday saw the pound plunge 5% against the dollar to just $1.03 before it managed to claw back two cents when London’s markets opened.

Further turmoil is anticipated and the Bank of England is expected to intervene to try and “save the pound” from collapsing further following chancellor Kwasi Kwarteng’s mini-budget on Friday. The £45 billion tax giveaway to Britain’s richest is to be paid for by massive borrowing.

It has already crashed the pound and shadow chancellor Rachel Reeves told Times Radio that she is “incredibly worried” by the financial markets reaction to Kwarteng’s mini-budget. Labour deputy leader Angela Rayner posted a graph showing sterling’s drop and tweeted: “This isn’t Bitcoin. It’s the British pound. The Tories are recklessly gambling – not with their own money – but all of ours.”

The chancellor’s doubling-down on Sunday – by insisting more tax cuts are on the way in his full budget (expected later this year) – has been called a “schoolboy error” by the Guardian.

That error has caused the pound to plummet even further past Friday’s lows, as soon as markets opened on Monday, with the value of sterling falling against every other currency in the world.

The Telegraph reports that government borrowing costs “have soared above” 4% for the first time in more than a decade as investors become “increasingly concerned about the new riskier direction of fiscal policy in the UK, sending gilt yields soaring and triggering a plunge in the pound to record lows.”

Cutting taxes for the rich by piling substantial debt on Britain’s ballooning deficit to try and stimulate economic growth, is seen as extremely reckless by many, including some Conservative MPs.

Their mood has been described as “anxious and uncomfortable” by a former minister who said of Kwarteng’s strategy, “if it was that simple, why didn’t someone do it before?

“We didn’t do it before because we knew there would be a problem.”

It has also opened a “serious split among Conservative MPs”, the Financial Times reports, with the party fracturing between “right wingers in favour of a radical agenda and those alarmed the chancellor has moved too far, too fast.”

Some MPs such as farming minister Mark Spencer have praised the government’s “ambitious” agenda, saying it will “stimulate growth within the economy that benefits us all.”

However, a senior Tory party figure, quoted by the FT questioned the levels of “expertise” in Liz Truss’s government, and said her team is seen as “lightweight” while No 10 and No 11 “are showing signs of being drunk on power.”

The Bank of England has already been urged to intervene to save the pound by hiking interest rates thereby undermining the efficacy of the tax cuts to stimulate growth. As the ex-minister said: “Income tax cuts are all well and good but if you get £150 a month off your income tax but end up paying £250 extra a month on your mortgage, what’s the point?”

The Conservative party conference in Birmingham starts next week and the new leader is likely to be given some time to prove herself by most Tory members. One ex-minister said a “rebellion is unlikely for now”.

However, the old adage that “a week is a long time in politics” may prove the former-minister wrong if the financial markets’ lack of confidence in Truss’s government continues – and the Tory party falls further behind Labour in the polls.