Experts say the UK economy is in a “terrible bind”, leaving no room for complacency or tax cuts. The Institute for Fiscal Studies (IFS) forecasts a ‘protracted period of high taxes and tight spending’. For 2024, the IFS predicts stubbornly high borrowing costs and a “moderate” recession in the first six months. The warnings mean the tax cuts many Tory MPs sought for the upcoming autumn statement are highly unlikely as the Chancellor must try to balance the books. The Bank of England’s chief economist hinted at further interest rate hikes against a backdrop of yet-to-be-tamed inflation.

The IFS report warns that the recession will likely last for nine months, with a 0.7 per cent GDP slump on the cards. The think tank’s director, Paul Johnson, told reporters:

“We are in a horrible fiscal bind.

“The price of our high levels of indebtedness, failure to stimulate growth, and high borrowing costs is likely to be a protracted period of high taxes and tight spending.”

The IFS said that Britain was caught between continuing high inflation and low growth, ruling out any room for a spending spree. Unfunded tax cuts would further increase inflation, forcing the BOE to raise interest rates once more and maintain high rates for a prolonged period.

Bank Citi, who produced the data for the IFS report, concluded that lower company profits and rising borrowing costs would dip the UK into a “moderate recession” early next year.

Government set for most significant tax take “in a generation”

The gloomy forecasts came as the UK economy is set for a record budget surplus. More money in taxes will flow into the state coffers than the government will spend. The Office of Budget Responsibility had estimated borrowings more than £20bn higher. However, the government is collecting more taxes on the back of rising wages.

The IFS’s Paul Johnson told reporters that the money raised by pushing employees into higher tax brackets as wages rise was “extraordinary,” and Labour lamenting a “stealth tax”. Shadow Chief Treasury Secretary Darren Jones said:

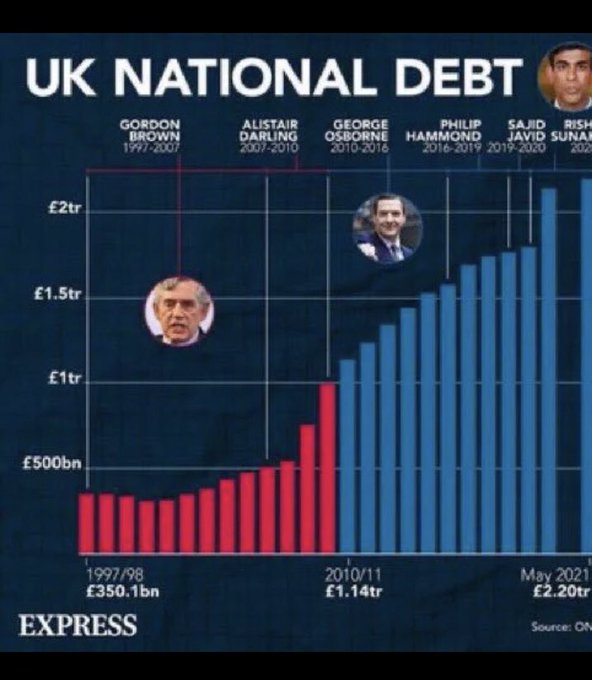

“Successive failures by Conservative ministers have left us with low growth, high tax and national debt at the highest level in generations.”

Despite significantly lower borrowings, interest payments on the national debt will rise, the IFS report maintains, sentiments echoed last week by the Chancellor. Speaking to Sky News, Jeremy Hunt predicted interest payments £30bn above forecasts for this year alone.

While the report predicts an increase in public spending for the short term, the IFS foresees budget tightening across all departments from March 2025 onward.

The Chancellor must now weigh up all the factors ahead of delivering the autumn statement at the end of November. A Treasury spokesperson said:

“Contrary to previous reporting, the UK’s growth projections have recently been dramatically upgraded, with the IMF confirming that the UK will grow faster than Germany, France and Italy in the long term, as well as being the fastest major European economy to recover from the pandemic.

“We must stick to our plan that we are delivering to halve inflation, which will help unlock sustainable growth, support families with the cost of living and get debt falling.”

With an election looming, the IFS fears the government will increase spending, leaving a potential Labour government in a dire situation if victorious in 2024.

Consumer Price Index (CPI) continues to fall as fight against inflation continues

Estimates predict a 4.3-per cent CPI by the end of the year, meaning Sunak will have kept his leadership campaign promise. According to the IFS, interest rates will likely stay above 5 per cent until the middle of next year, when the BOE can potentially start considering reductions. But rate cuts may be a long way off. An IFS spokesperson said:

“The Monetary Policy Committee may want to wait for firm evidence of disinflation before it considers cutting rates. But by that point, it might be too late, and the result could be a deep recession.”

Huw Pill, Bank of England chief economist, hinted at a further interest rate increase on Monday.

“We still have some work to do in order to get back to [the inflation target of 2 per cent].

“And we probably have some work to do to ensure that, when we get back to 2 per cent, we do so in a way that is sustainable through time.”